UPDATE - Fed Has Released the Following Statements on the SIVB Situation

These came out after my preview was done.

federalreserve.gov/newsevents/...https://www.federalreserve.gov/newsevents/pressreleases/monetary20230312b.htm

TLDR - If you are a bank and are doing poor risk management, we will shut you down and make sure the depositers are made whole. Historical...

Last Week Recap -

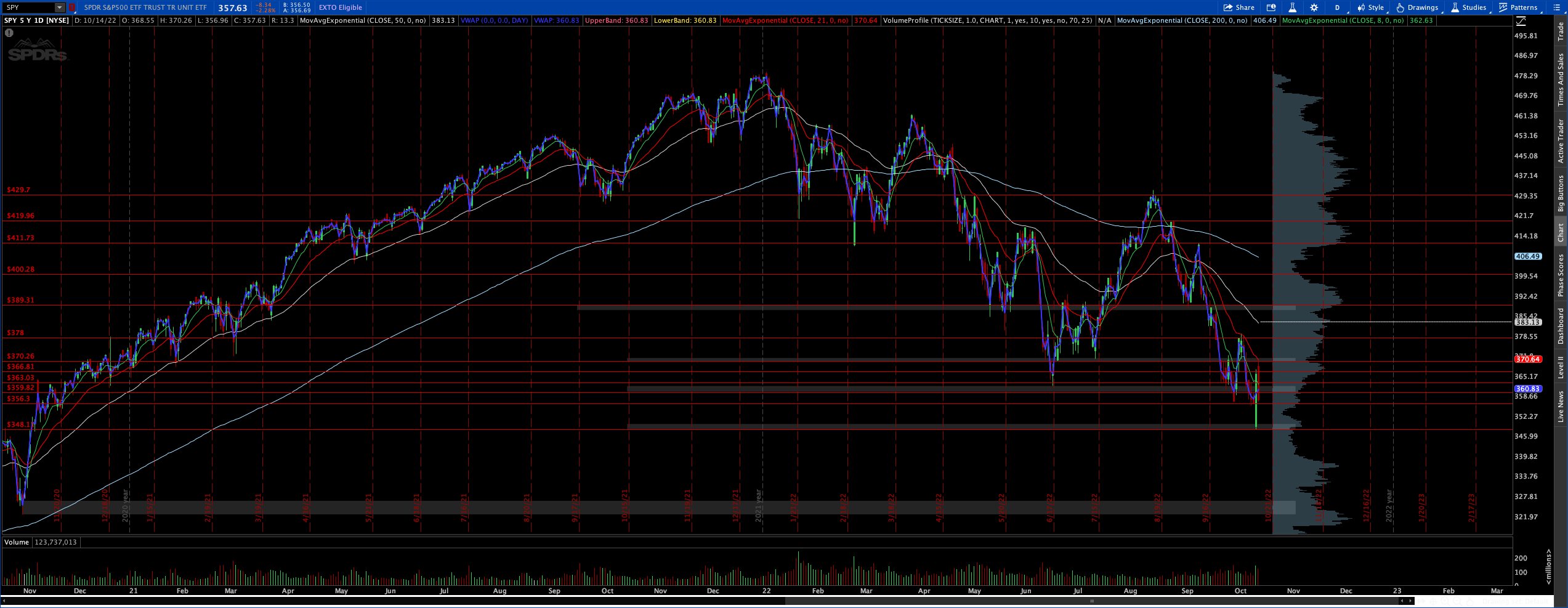

What a week... SPY went to a high of 407 to 384. That is a massive range and SPY was actually trading at 401 on Thursday morning. So effectively, we saw a 17 point drop in 2 days as we closed near the lows of the week on Friday. So what happened?

Jerome Powell testified in front of Congress and we saw the hawk come back out. 50 BPS is now back on the table and the Fedswaps actually have it favored above 25 BPS. We also had nonfarm payroll data releasing on Friday, and it came in pretty bullish for the inflation trade. Lower wage rate, and higher unemployment gives a tip to the Fed that their actions may start to be working and thus they can back off some. So with that data, why didn't we blast higher? We had a black swan event.

Silicon Valley Bank had a bank run. They announced they were looking at raising $2billion and that spooked customers and immediately triggered a bank run. The stock plummeted and the bank is now under FDIC control. This has caused actual fear in the markets that is this a systemic issue or a one off problem. I am no banking expert, nor do I invest in the financial sector so I am going to let the chips fall as they may. There are a lot of theories floating around, and I think 99% of them get debunked by midweek. But... the fear is real and that fear can stick around in the back of people's minds for awhile. So did we just shift into the recession theme?

Let's move on to the bullish and bearish thesis section to see what lies ahead.

Bearish Thesis -

- 2 Week outlook

- Bears got a small "something is going to break" event last week with SIVB's bankrun. Now with those fears present, the market took a pretty emphatic move lower. We have CPI and retail sales this week, and FOMC is in two weeks. The technicals also show SPY back under the bear market trendline. With the SIVB fear present, and those major data releases upcoming, the bears look to be back in control.

- 1 month outlook

- The FOMC meeting now becomes an even more critical meeting. 50 BPS is back on the table and it appears the Fed's policies maybe starting to seeing its impact on the economy. However, it is not slowing inflation down which is the primary enemy. So JPow can get away with one more 50 BPS hike here and then resort back to the 25BPS hikes for future meetings.

If we get an economic projection of the Fed funds rate over 550 BPS,. This should cause a move back to SPY 380 as long as JPow maintains his 2% inflation mandate stance in the presser.

- 3 months+ outlook

- Regardless of the Fed's decision in March, the data is showing that inflation is not only sticking, but is also rising again. So inflation is showing that it is control, so no matter how the market wants to spin the narrative, if inflation is not dealt with, it will crush the consumer. There is no magic bullet that will get it under control outside of a recession. So bears are playing for the inevitable recession. (Same as last week)

Bullish Thesis -

- 2 Week Outlook

- Something broke in the economy and that something was SIVB. But... is this a systemic issue or a one off? If the SIVB issues get worked out via a govt. bailout or a private acquisition, the market will look to regain the 390 support and retest the bear market trendline. CPI is on Tuesday, so if that data comes in cooler, we are squeezing all the way until FOMC. What a shift a few days can make where the bulls are now relying on data to save them. Now if SIVB, does not get a timely resolution, the market may react negatively to this. However, SVIB failing could signal the Fed to only do 25 BPS hike in the next FOMC meeting and start the discussion of pausing in the economic projections.

- 1 Month Outlook

- SIVB be damned, the jobs data gave the Fed a possible soft landing scenario. Low wage rate increase (no wage spiral) and higher unemployment (softening of labor conditions). Inflation is in control so no landing is here! This will be the bullish narrative to allow them to dismiss the hot inflation data. Even if JPow says that 2% is the mandate in the March FOMC meeting, bulls will not believe him due to SIVB breaking. He is closer to pausing rates and then he will just live with the results for a year with the rates at 5 to 5.25%. This will create a sweet spot where the Fed signals when it is pausing regardless of the current inflation reports, while the consumer is strong and unemployment is low.

- 3 Month Outlook

- The no landing sticks, then we know that only a natural recession will bring the markets down. The Fed will not manufacture the recession and it will be up to whether inflation can stay back long enough for the consumer to stay strong. The theory here is that inflation is and was ultimately a supply side issue and those issues would be resolved by then. If this is the case, and inflation starts to slightly tick down while the Fed has paused, the market will explode higher as they will anticipate that a major recession will not happen. It will only crash or come down once the consumer has slowed down by the sticky inflation, thus causing an economic recession. (same as last week)

I do not agree with one side of this narrative, but it is important to present all sides of the argument. Over the next few weeks, I will keep building and updating these narratives.

My Prediction -

I was wrong last week as we did not see a sustainable pop after the pullback. I got caught holding longs, but my stops kicked in and allowed me to save a green week.

We have an eventful week ahead. CPI is Tuesday, Retail sales is Wednesday, ECB Rate hike decision is Thursday and the sneaky UoM Sentiment report is Friday. All while, everyone is awaiting the fallout from the SIVB crisis.

If the CPI data comes in hot, does that put 50 BPS hike back on the table? Does the Fed even consider 50 BPS again since the banking sector is a bit shaky right now.

I am looking for a rebound on the SIVB situation getting resolved. CPI being Tuesday, so I anticipate some de-risking on Monday. There is no real point to playing any bigger trades until that data is presented. Retail sales on Wednesday will be critical for us to determine how far off is the recession, and if the consumer is still as strong as it has shown in previous months.

So the play I am looking at getting into is a gold miner, NEM. With risk off getting more attention, Gold looks to be catching a bid. So I will grab some calls for June sometime this week.

I will continue to scalp the indicies for small plays this week.

Economic Data this Week (all times are EST)? -

- Check the full calendar here. No Fed Speakers this week. They are in a blackout period: stonks.chat/feed/catalysts

- Monday - Nothing major

- Tuesday -CPI at 8:30am

- Wednesday - Retail Sales at 8:30am

- Wednesday - PPI Data at 8:30am

- Wednesday - Business Inventories at 10:00am

- Thursday - Building Permits at 8:30am

- Thursday - Import/Export Data at 8:30am

- Thursday - EU Interest Rate Decision at 9:15am (DXY implications)

- Friday - UoM Sentiment at 10am (sneaky report)

Current Positions and Plays -

- I am all cash and looking at scalping and entering some longer dated calls for Gold miners.

SPY Technicals -

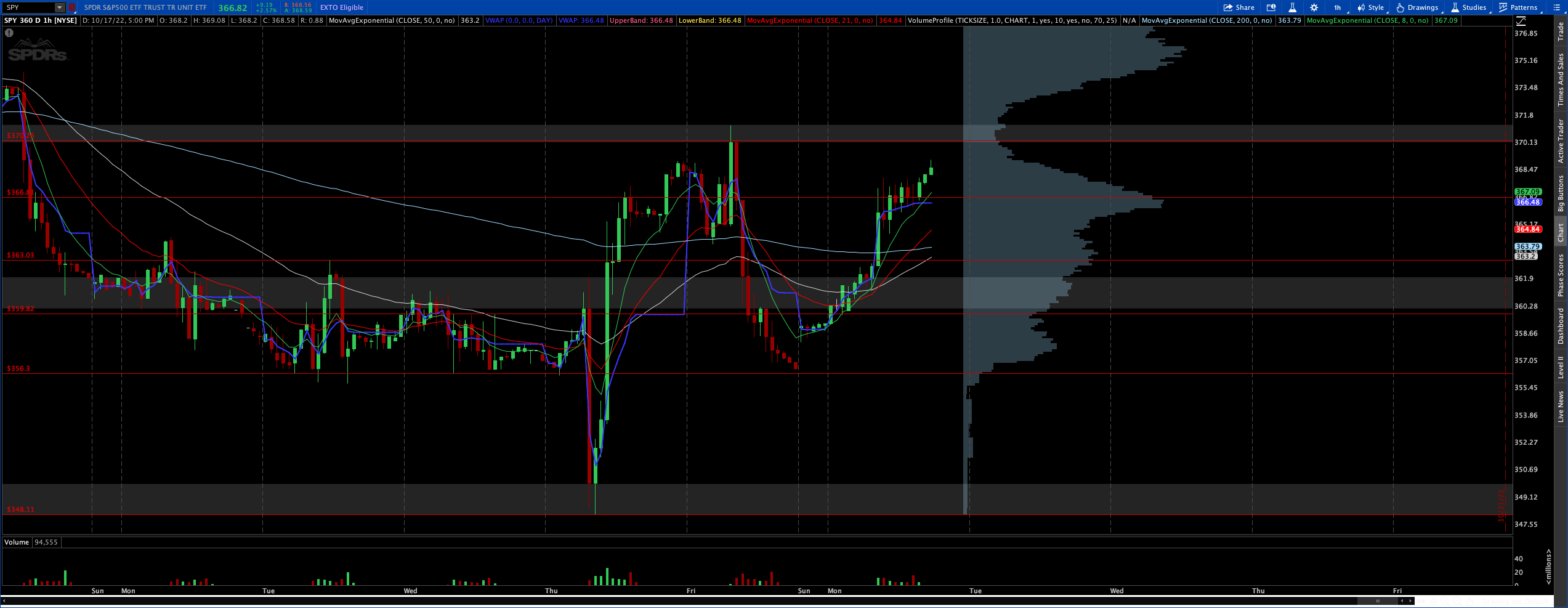

- SPY Technicals - The 30 min, 1 hour, and 4 hour are oversold. Daily is close to oversold.

- SPY broke below the bear market trendline and the 200MA on the Daily chart.

- SPY Fibs for Dec 2022 low to 2023 high (current rally) - Purple fibs on the chart.

- 401 is the .382

- 391 is the .618

- 396 is the .500

- SPY Fibs for ATH to June 2022 low - 389 is the .236 line. 407 is the .382 line. Light green fibs on the chart.

- SPY Fibs for COVID low to ATH - 380 is the .382 line. 416 is the .236 line. Gold fibs on the chart.

Levels I am Watching

- $SPY - levels 383, 385, 390 (major), 393, 396

- $QQQ - levels 285, 288, 290 (major), 293, 296

- NOTE: I have turned back into a daytrader. I love playing ES and NQ futures.

- This is not financial advice